nebraska sales tax calculator

Nebraska State Sales Tax. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with.

Nebraska Income Tax Calculator Smartasset

The average cumulative sales tax rate in Lincoln Nebraska is 688.

. The Nebraska state sales and use tax rate is 55 055. The calculator will show you the total sales tax amount as well as the county city. Find your Nebraska combined state.

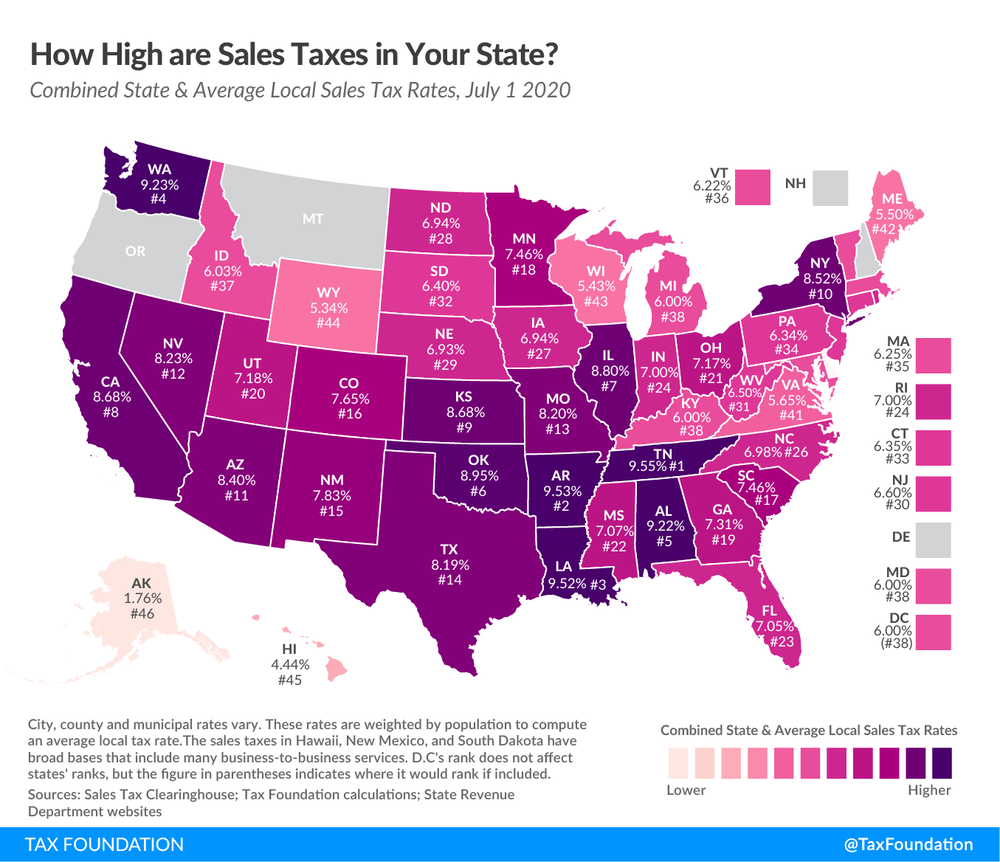

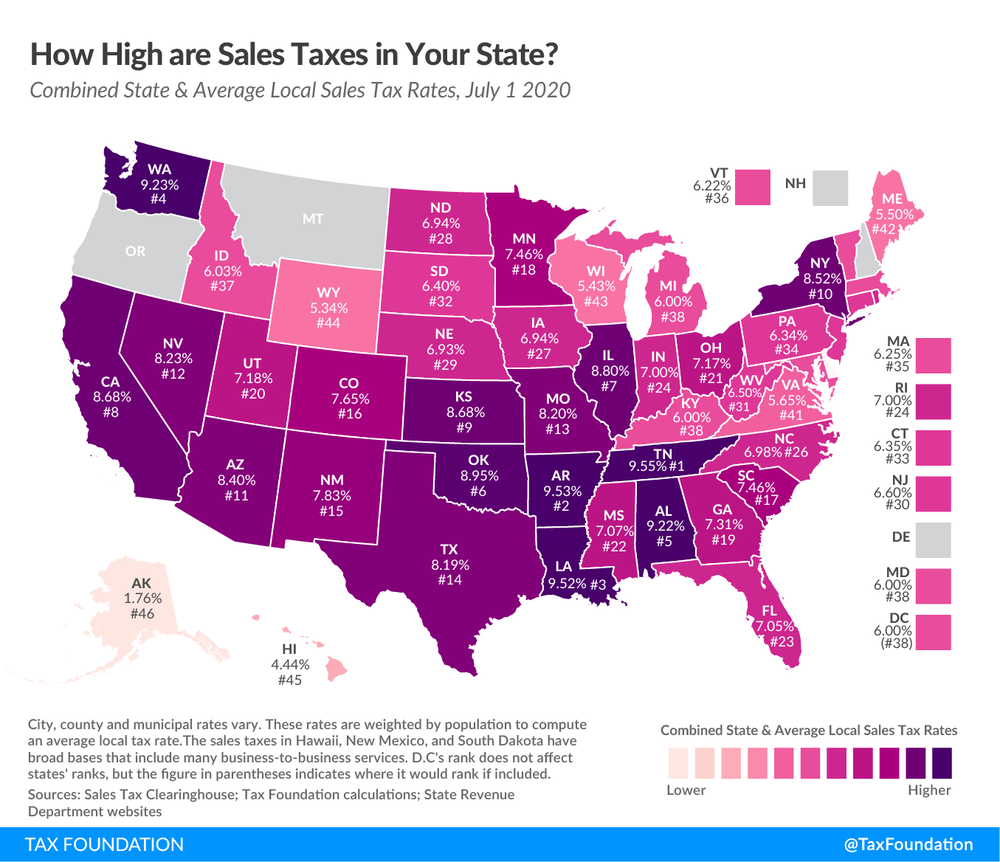

With local taxes the total sales tax rate is between 5500 and 8000. This includes the rates on the state county city and special levels. So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate.

All numbers are rounded in the. You can calculate the sales tax in Nebraska by multiplying the final purchase price by 055. This includes the rates on the state county city and special levels.

There are four tax brackets in. Nebraska is a destination-based sales tax state. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 605 in Nebraska.

Lincoln is located within Lancaster County. Ad Our tax preparers will ensure that your tax returns are complete accurate and on time. The Nebraska NE state sales tax rate is currently 55.

The Nebraska state sales and use tax rate is 55 055. Reduce complexity by outsourcing the preparation and filing of sales tax returns to Sovos. How to Calculate Nebraska Sales Tax on a Car.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. The state sales tax rate in Nebraska is 5500. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

Its a progressive system which means that taxpayers who earn more pay higher taxes. Nebraskas state income tax system is similar to the federal system. The average cumulative sales tax rate in Omaha Nebraska is 686.

To determine the income with which to calculate your tax bill in Nebraska you begin with your federal adjusted gross income AGI. Just enter the five-digit zip. The base state sales tax rate in Nebraska is 55.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. The Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Nebraska in the USA using average Sales Tax Rates andor specific Tax Rates by. Sales Tax Rate s c l sr.

So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. Request a Business Tax Payment Plan.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Average Local State Sales Tax. Sales Tax Rate Finder.

Maximum Possible Sales Tax. Omaha has parts of it located within Douglas County. Sales Tax Table For Nebraska.

Sales and Use Tax. ArcGIS Web Application - Nebraska. With local taxes the total sales tax rate is between 5500.

Make a Payment Only. For example lets say that you want. This can be found on IRS Form 1040.

Maximum Local Sales Tax. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Nebraska Sales Tax Rates By City County 2022

11 9 Sales Tax Calculator Template

Nebraska Sales Tax Small Business Guide Truic

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Compared To Rivals Nebraska Takes More From Taxpayers

Nebraska Sales Use Tax Guide Avalara

Capital Gains Tax Calculator 2022 Casaplorer

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Register For A Sales Tax Permit Taxjar

Sales Tax Calculator Credit Karma

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Your Guide To The United States Sales Tax Calculator Tax Relief Center